Posted in Car Accidents, Drunk Driving Accidents on July 2, 2025

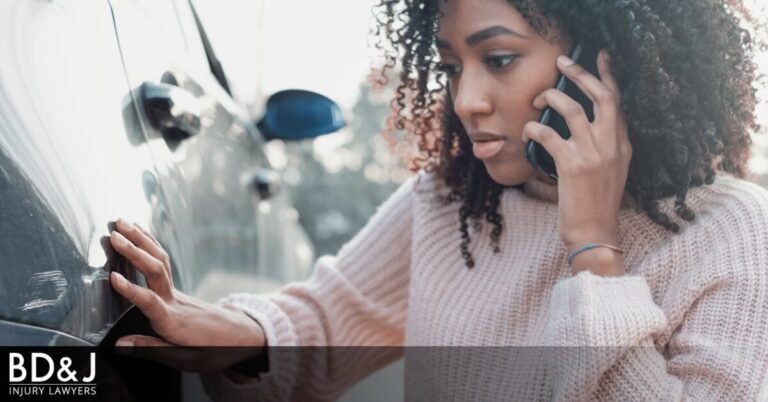

Long Beach is a city of summer fun, but much of its appeal also causes an increase in DUIs. While drunk driving is also a criminal offense, victims may also file claims against drunk drivers for civil, monetary damages if they are injured or a loved one is killed in a crash due to a DUI. If you’ve been hurt in a Long Beach drunk driving accident, contact BD&J’s drunk driving car accident lawyers in Long Beach to seek justice.